What are the Main Factors Influencing White Paper Board Price in 2025?

The pricing of white paperboard is a complex interplay of global commodity markets, regional manufacturing dynamics, and evolving end-user demands. For procurement managers, converters, and brand owners, understanding these multifaceted drivers is not merely academic—it is essential for strategic sourcing, budgeting, and risk management. This analysis provides an engineer-level examination of the primary factors shaping the white paper board price outlook for 2025, moving beyond surface-level trends to explore the underlying mechanics of cost and value.

Core Driver 1: Upstream Raw Material and Input Costs

The most direct and volatile cost component stems from upstream raw materials, whose prices are set on global markets and directly impact the white paper board price per ton.

Pulp Market Dynamics

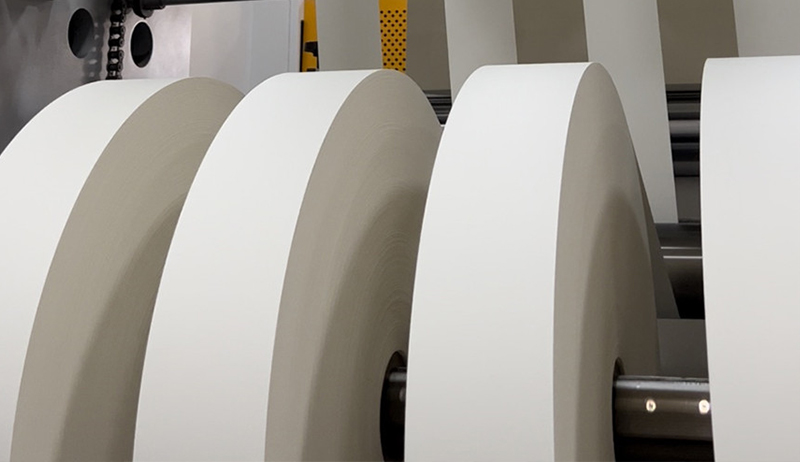

White paperboard, especially high-grade Solid Bleached Sulfate (SBS) board, is predominantly produced from virgin wood pulp. The price of key pulp grades—primarily Bleached Hardwood Kraft (BHKP) and Bleached Softwood Kraft (BSKP)—is the foundational cost driver. Softwood pulp provides strength, while hardwood pulp offers smoothness and formation; fluctuations in either directly transfer to board manufacturing costs. Global pulp supply is influenced by forestry cycles, mill maintenance schedules, and geopolitical factors affecting major producing regions like North America and Scandinavia.

Energy, Chemicals, and Logistics

Manufacturing is energy-intensive. Natural gas and electricity prices, which have seen structural shifts, are significant and largely non-negotiable input costs. Furthermore, the production of coated white paper board involves premium coating pigments (like calcium carbonate) and binders (like latex), whose costs are tied to petrochemical markets. Finally, logistics—both inbound (pulp delivery) and outbound (finished goods distribution)—add a variable layer of expense sensitive to fuel prices and regional freight capacity.

Core Driver 2: Product Specifications and Manufacturing Complexity

Not all white paperboard is created equal. The cost structure varies significantly based on technical specifications, creating defined price tiers in the market.

- Basis Weight and Caliper: Heavier grammages (e.g., 350 gsm vs. 230 gsm) consume more fiber per unit area, linearly increasing material costs. Production speeds for heavier board may also be lower, affecting mill efficiency.

- Coating and Finishing: The coated white paper board price includes the cost of multiple coating layers, supercalendering, and potential specialty finishes (matte, glossy, textured). Each additional processing step adds capital, energy, and material expense, but is critical for high-end printability and visual appeal.

- Grade Composition – The SBS Premium: A deep dive into SBS white paper board price factors reveals that its 100% virgin chemical pulp content, superior brightness, stiffness, and purity for food contact command a substantial price premium over grades containing mechanical pulp (like FBB or WLC), which have lower raw material costs but also lower performance characteristics.

Core Driver 3: Regional Supply-Demand Fundamentals

The balance between available capacity and market demand creates the pricing environment in which cost-based prices are realized.

Capacity Investment Cycles

The timing of new large-scale mill startups is a crucial variable. Significant new capacity coming online in a region within a short period can temporarily suppress prices due to increased competition for market share, even if input costs are rising. Conversely, a lack of investment or mill closures can tighten supply.

End-Use Demand Evolution

Demand is fragmented across sectors. Stable growth in premium packaging (cosmetics, electronics, pharmaceuticals) supports higher-value board. The "paperization" trend, substituting single-use plastics in food service and retail, creates new demand streams, though often for cost-competitive grades. Economic cycles affecting consumer spending directly impact order volumes from converters and brands.

Industry Context: Sustainability and Regulatory Costs

The operating landscape is increasingly shaped by non-traditional cost factors linked to environmental policy. According to a 2024 comprehensive report by the European Paper Packaging Alliance (EPPA), regulatory measures like the EU's Packaging and Packaging Waste Regulation (PPWR) and expanded producer responsibility (EPR) schemes are systematically internalizing the costs of recycling and end-of-life management into product pricing. Furthermore, the integration of circular economy principles is having a measurable impact. Data from the report indicates that demand for paperboard containing recycled fiber is growing at a rate 1.5 times that of virgin fiber-based board in key European markets, influencing production and sourcing strategies. While this trend supports grades like White Lined Chipboard (WLC), it also places upward pressure on the cost of high-quality recycled fiber, creating a new dynamic in the white paper board vs kraft paper price comparison, as both face similar sustainability-linked cost pressures.

Source: European Paper Packaging Alliance (EPPA) - 2024 Market & Sustainability Report

Competitive Landscape and Substitute Materials

Price is also set relative to available alternatives. A clear white paper board vs kraft paper price comparison is fundamental. While kraft paper offers superior strength and is often cheaper on a per-ton basis, white paperboard provides the bright, printable surface essential for branding and graphics, justifying its premium for most consumer packaging. However, in applications where print quality is secondary, kraft paper can act as a price ceiling. Similarly, developments in plastic packaging, especially recycled PET, and its pricing influence demand at the margin for certain rigid packaging applications.

2025 Price Forecast Synthesis and Procurement Strategy

Synthesizing these drivers leads to a nuanced white paper board price forecast 2025. The baseline expectation is for prices to remain elevated with moderate volatility, supported by firm pulp costs and sustainability-driven operational expenses but tempered by careful capacity additions.

| Price Driver | 2025 Projected Influence | Risk Direction |

| Pulp Costs | Moderately Bullish. Expected to remain above historical averages. | Upside: Geopolitical disruptions, stronger demand. Downside: Global economic slowdown, significant new pulp capacity. |

| Energy & Chemicals | Neutral to Bullish. Structural energy transition costs persist. | Upside: Oil/natural gas price spikes. Downside: Rapid adoption of renewable energy at mill sites. |

| Sustainability Regulations | Firmly Bullish. A growing, non-negotiable cost component. | Upside: Faster-than-expected implementation of carbon taxes or EPR fees. |

| Supply-Demand Balance | Varies by Region. Generally balanced in major markets. | Upside: Unplanned mill outages, surge in demand. Downside: Delayed demand recovery, aggressive new capacity ramp-up. |

Strategic Procurement Recommendations

- Diversify Supplier Base: Engage with mills in different geographic regions to mitigate regional supply risks.

- Consider Total Cost of Ownership (TCO): Evaluate board grades not just on price per ton, but on conversion efficiency (runnability on presses, fewer rejects) and end-product performance.

- Implement Price Risk Management: For large volumes, explore fixed-price annual contracts or indexed pricing formulas to manage volatility.

- Technical Collaboration: Work with suppliers to explore "right-weighting" or alternative grade specifications that meet performance needs at a lower grammage or cost tier.

Frequently Asked Questions (FAQ)

1. What is the typical price premium for coated versus uncoated white paperboard?

The premium for coated white paper board can vary from 15% to 35% or more above an uncoated sheet of the same base weight and pulp quality. This premium covers the cost of coating materials (pigments, binders), the application and drying process, and supercalendering for smoothness. The exact premium depends on the number of coating layers and the sophistication of the finishing process.

2. How significant is the role of ocean freight costs in the delivered price of imported white paperboard?

For intercontinental trade, ocean freight is a critical and highly variable component. It can represent 5% to 15% of the landed cost per ton. During periods of port congestion or container shortages, this figure can spike dramatically. This makes the delivered price of imported board highly sensitive to global logistics conditions, a key consideration when comparing domestic and imported suppliers.

3. How do “green” certifications like FSC affect the price?

Forestry certifications like FSC (Forest Stewardship Council) typically add a modest, stable premium to the white paper board price, often in the range of 3-8%. This covers the cost of chain-of-custody auditing and sustainable forestry management. This premium is increasingly becoming a standard market requirement in many regions and consumer-facing segments, shifting from a niche differentiator to a cost of market access.

4. Can the price of recycled paper influence the price of virgin white paperboard (SBS)?

Yes, but indirectly and within a band. High-quality recycled white paperboard (WLC) serves as a functional substitute for SBS in some applications. If the price of recycled board rises significantly due to strong demand for recycled content, it can make virgin SBS more competitively priced for converters, potentially supporting its price floor. Conversely, cheap recycled fiber can exert downward pressure on lower-tier virgin grades.

5. What is a more reliable indicator for future price movements: pulp futures or paperboard producer price indices (PPI)?

For forward-looking insight, pulp futures traded on commodities exchanges (like Fastmarkets FOEX) are a leading indicator, as pulp cost changes take 1-3 months to filter through to paperboard selling prices. Producer Price Indices are lagging indicators, confirming trends that have already been established in the market. Savvy buyers monitor both: pulp futures for cost pressure direction and PPI data for validating the extent of price pass-through from suppliers.

English

English Español

Español